We have successfully served 20000+ happy clients across the globe.

We rapidly update our data bank of import-export from the shipment record of over 100+ countries.

Seair is the first to provide free search in USA Import-Export data

Seair Exim solutions contribute to your growth by following points.

Expand your business’ reach to new markets as per demands across the globe. We help our clients tap global business opportunities by providing them with an import and export database of millions products. Identify challenges across borders, tap onto them and rise. It has never been easier for traders to identify the opportunities on global scales; the only catch is the utilisation of accurate and updated data of active consumers.

“Understanding competitors’ activity today helps you prepare for tomorrow.” Won’t it be fantastic if you can monitor and oversee the activities and status of your direct competitors in the industry? Keeping an eye on your closest competitors helps your business stand a better position in the market and eventually surpass them to emerge as the leading authority. Examining the market is always an upper hand, as it ensures that you are updated with the ongoing fluctuations in the market and are not shooting a dart in the dark.

With the precise use of our customised trade data sets, you can directly network to an assortment of people in business, companies, logistic partners, manufacturers, traders and, in return, take your business to heights never assumed before. It is rightly said, “If you don’t network, you don’t grow.” With the usage of real-time activity and trade history, you can tap on to the windows of pitching in your service and close a deal thereafter. When the world is just a click away, why should your business suffer the limitations of geographical boundaries - LET IT GROW.

Our consumer analysis database can help businesses maximise Customer Lifetime Value (CLV). CLV is the measure of the profit earned through selling to a consumer or a group against the expense of marketing to those consumers. With a consumer analysis report, a business can likewise find other opportunities to pitch in different services, commodities or products that fit their personalities as consumers. No rocket science, but sheer use of technology when you can.

Bring down competition through the analytical report of shipment records of your competitors in the industry. A description like this prepares your business for comparative performance in the domain you deal in. When you know where your competitors make the highest profits and where they lose the most, in that case, you can always be smart enough to tailor business’ strategies by learning from the statistical and analytical report on their (competitors) shipment data records.

Seair Exim proudly boasts a team of supremely skilled data scientists and researchers who are very careful with the analysis. They prepare and keep themselves regularly updated with the changes in the system. This helps our team ensure efficient use of export import trade data sets at any point in time, irrespective of the market scenarios. Only after a detailed understanding regarding the requirements of the client’s motive behind the procurement of data sets, our data experts move on to the next step, where they draw out relevant solutions and conclude the report by wrapping valid trade database.

Seair is your end-to-end solution for all the export-import data. Seair arms your business with insight depth analysis’s report of place, potential, the latest trend to boost your position in the market. Seair team uses modern tools to provide you a refined statement based analysis of Import-Export duty of every country. Access Report based data on Import-export

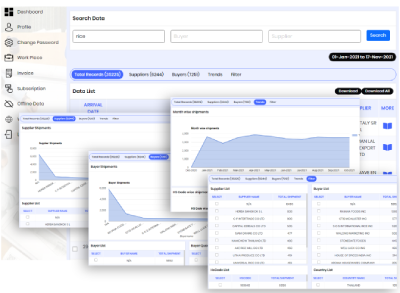

We at Seair exim solutions offers a dedicated dashboard for USA import data users. USA raw trade data is very ill organised and can be extremally time consuming for clients to make use of trade dataset. This is where our dashboard helps you search through the millions of records and transform these records in usable information.

DATA UPDATE: - 31-Mar-2024

We at Seair Exim Solutions prepare the trade data for every country of the world using modern techniques. You can visit our website to know the data on an import-export business.

Stay updated about the world of import-Export trading and logistics markets with real-time updates.

Garlic is an herb that grows all over the world. It belongs to the Allium genus and is closely related to onions, chives, and leeks. It is commonly used for seasoning in cooking and also has therapeutic benefits. Garlic produces the chemical allicin, which gives it a pungent odour.

Read MoreCanada, the world's second-largest country in terms of land area, boasts a diverse and dynamic economy. It thrives in the service sector and is heavily reliant on natural resources. According to the World Bank's sources, Canadian imports of goods and services (% of GDP) were a significant 33.71% in 2022, showcasing the complexity and richness of Canada's trade.

Read MoreDo you know? India has the globe's fourth-biggest fish export market. India, with a long coastline and abundant aquatic resources, is a prominent player in the worldwide fish market.

Read MoreThe Philippines, a Southeast Asian archipelago nation, is a major player in the world commercial scene. The Philippines' economy is an emerging market, classified as a newly industrialized country in the Asia-Pacific area. In 2022, the Philippines' GDP increased by 7.6 percent.

Read MoreIndia leads in coconut production, pivotal for various industries. With 21,500 million tonnes annually, coconut is a major export commodity. Tamil Nadu, Kerala, Karnataka, and Andhra Pradesh drive India's coconut exports, meeting global demand.

Read MorePaper cups are becoming more popular nowadays due to their several benefits. However, the paper cups market is a prominent component of the foodservice and beverage packaging industry, offering environmentally friendly and convenient disposable cups manufactured of paperboard.

Read MoreIndia, recognized for its strong agricultural sector, has emerged as a major player in the global cattle feed business. With a growing global demand for high-quality cattle feed, Indian exporters have profitable potential to increase their market reach.

Read MoreMango is a popular fruit around the world, known as the king of fruits. India's mangoes are well-known for their sweetness, diversity, and brilliant colors. It is also one of the largest mango producers, which makes it an excellent location for mango exports.

Read MoreIndia, a fruit powerhouse due to its climate and agriculture, offers year-round fruit export opportunities. As the world's second-largest producer, it's a profitable venture, catering to high demand in the US, Europe, Hong Kong, Vietnam, and beyond.

Read MoreIndia, renowned for its diverse culinary heritage, leads globally in spice exports. The top 10 spices exported from India include red chilli, cumin, coriander, turmeric, and more, essential in various cuisines and industries worldwide. Explore further to understand the spice export dynamics.

Read MoreWe have successfully served many reputable clients for Import-Export Data Information Services. Here are some of our clients:

Seair Exim Solutions helps businesses to enhance their international business by providing import-export data sets of global countries. We offer direct access to the data of importers and exporters by providing the traders immense business opportunities. We offer international buyers a detailed list of all the excellent exporters. Seair Exim Solutions provides a comprehensive list of data for their customers.

Seair Exim Solutions is dedicated to assisting business ventures by offering precise global data of buyer and exporters. This data helps with all the relevant information with all the appropriate details that helps them to take part in the trading process. We at Seair Exim keeps the data updated regularly, as this boosts their client's business. This trade data we offer comes with all the updated information, recent market details.

Seair Exim envisions connecting its clients to the global trade community. We help them by providing the best business solutions and also provide professional guidance to use the provided information for their maximum benefits and ensures constant mutual growth. Seair Exim solutions help out the traders to know the present trends of the market to do international trade.

We at seair provide updated import and export information regularly.

21-Feb-2024

09-Jan-2024

28-Dec-2023

04-Dec-2023

29-Nov-2023

14-Nov-2023

17-Oct-2023

09-Oct-2023

03-Oct-2023

27-Sep-2023

15-Dec-2021

12-Nov-2021

13-Oct-2021

07-Oct-2021

04-Oct-2021

Copyright © 2009 - 2024 www.seair.co.in. All Rights Reserved.